https://a16z.com/generative-ai-enterprise-2024/

Generative AI took the consumer landscape by storm in 2023, reaching over a billion dollars of consumer spend1 in record time. In 2024, we believe the revenue opportunity will be multiples larger in the enterprise.

Last year, while consumers spent hours chatting with new AI companions or making images and videos with diffusion models, most enterprise engagement with genAI seemed limited to a handful of obvious use cases and shipping “GPT-wrapper” products as new SKUs. Some naysayers doubted that genAI could scale into the enterprise at all. Aren’t we stuck with the same 3 use cases? Can these startups actually make any money? Isn’t this all hype?

Over the past couple months, we’ve spoken with dozens of Fortune 500 and top enterprise leaders,2 and surveyed 70 more, to understand how they’re using, buying, and budgeting for generative AI. We were shocked by how significantly the resourcing and attitudes toward genAI had changed over the last 6 months. Though these leaders still have some reservations about deploying generative AI, they’re also nearly tripling their budgets, expanding the number of use cases that are deployed on smaller open-source models, and transitioning more workloads from early experimentation into production.

This is a massive opportunity for founders. We believe that AI startups who 1) build for enterprises’ AI-centric strategic initiatives while anticipating their pain points, and 2) move from a services-heavy approach to building scalable products will capture this new wave of investment and carve out significant market share.

As always, building and selling any product for the enterprise requires a deep understanding of customers’ budgets, concerns, and roadmaps. To clue founders into how enterprise leaders are making decisions about deploying generative AI—and to give AI executives a handle on how other leaders in the space are approaching the same problems they have—we’ve outlined 16 top-of-mind considerations about resourcing, models, and use cases from our recent conversations with those leaders below.

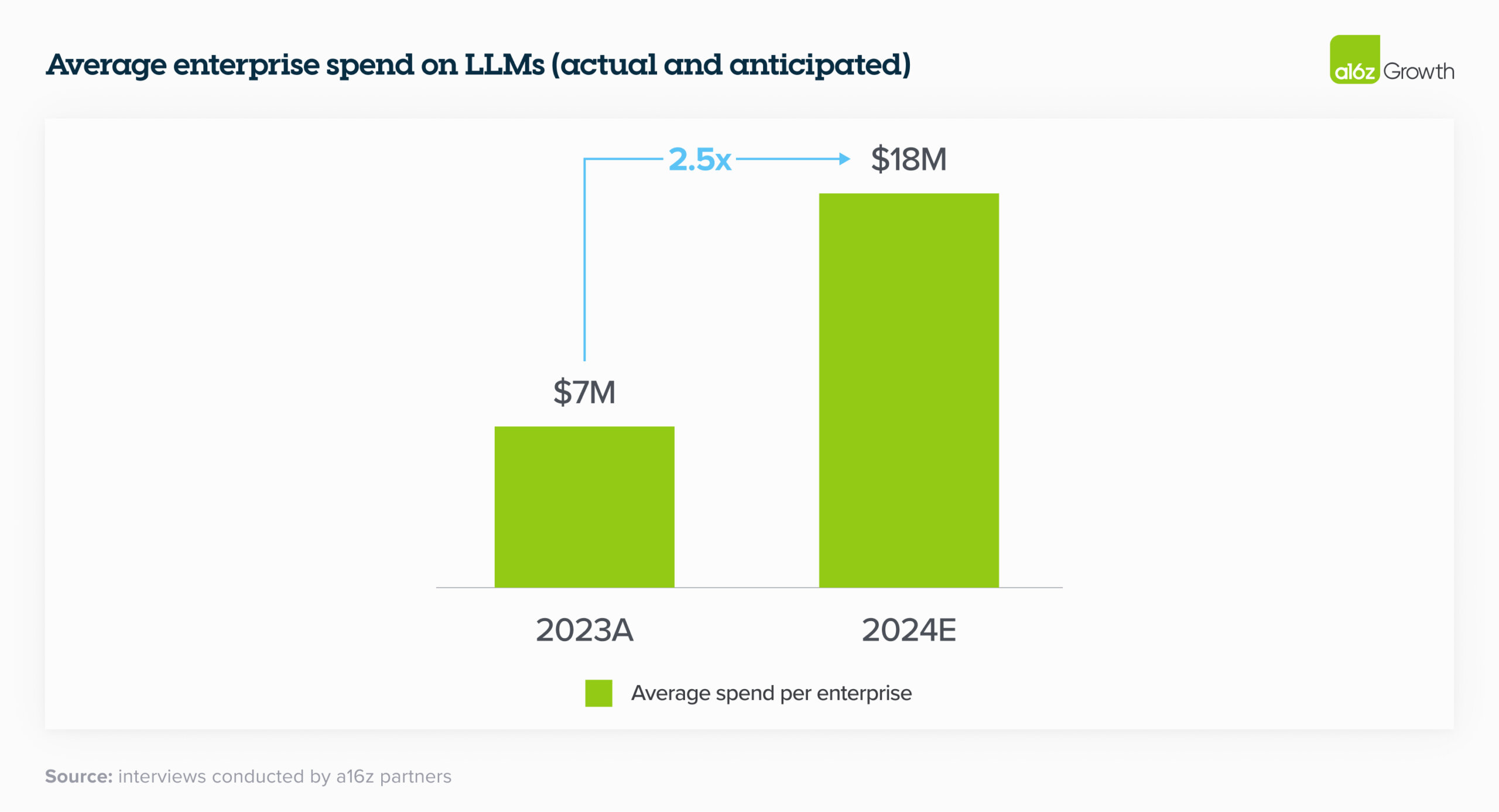

In 2023, the average spend across foundation model APIs, self-hosting, and fine-tuning models was $7M across the dozens of companies we spoke to. Moreover, nearly every single enterprise we spoke with saw promising early results of genAI experiments and planned to increase their spend anywhere from 2x to 5x in 2024 to support deploying more workloads to production.

average enterprise spend on llms

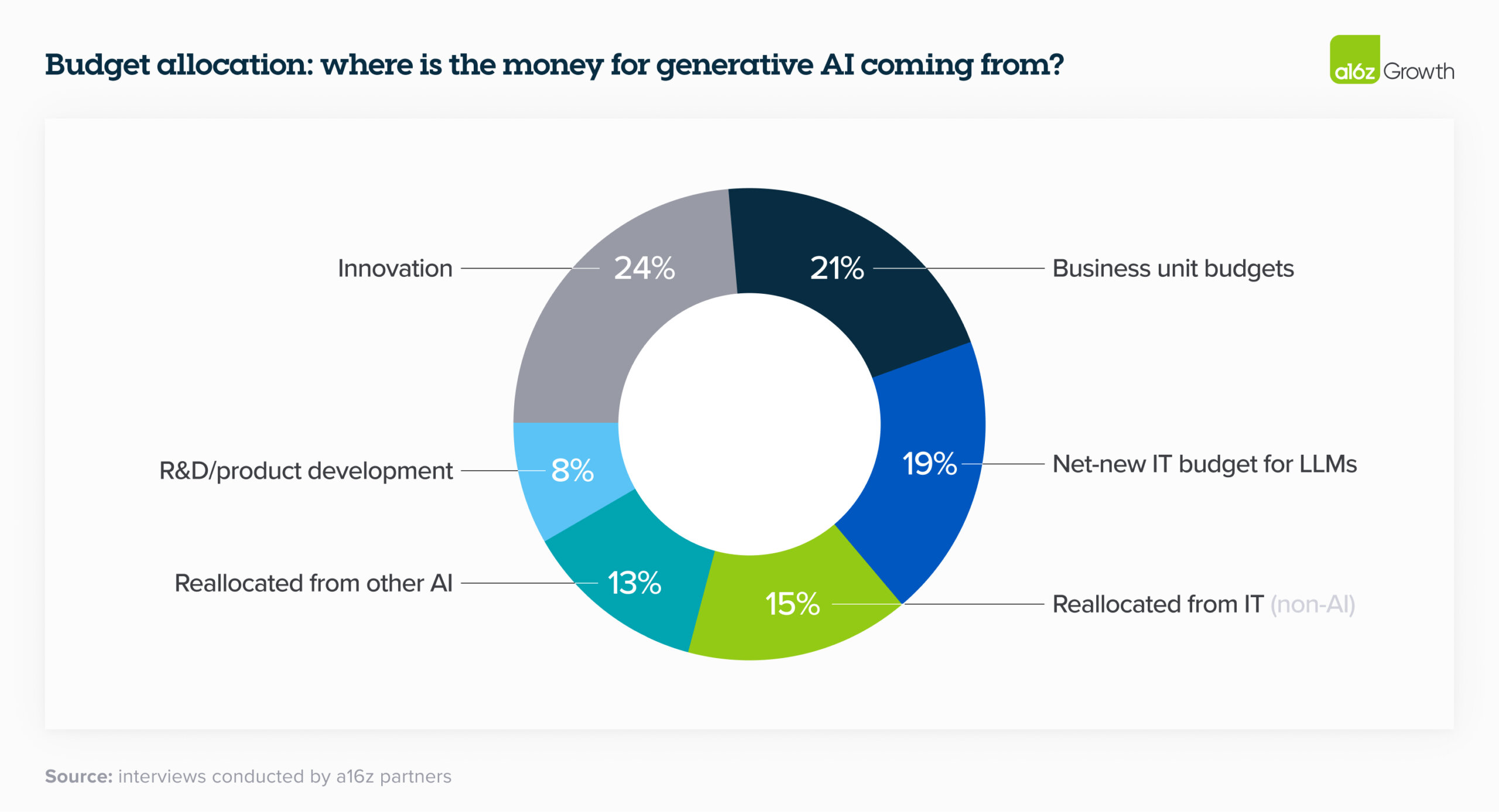

Last year, much of enterprise genAI spend unsurprisingly came from “innovation” budgets and other typically one-time pools of funding. In 2024, however, many leaders are reallocating that spend to more permanent software line items; fewer than a quarter reported that genAI spend will come from innovation budgets this year**.** On a much smaller scale, we’ve also started to see some leaders deploying their genAI budget against headcount savings, particularly in customer service. We see this as a harbinger of significantly higher future spend on genAI if the trend continues. One company cited saving ~$6 for each call served by their LLM-powered customer service—for a total of ~90% cost savings—as a reason to increase their investment in genAI eightfold. Here’s the overall breakdown of how orgs are allocating their LLM spend:

llm enterprise budget allocation

Enterprise leaders are currently mostly measuring ROI by increased productivity generated by AI. While they are relying on NPS and customer satisfaction as good proxy metrics, they’re also looking for more tangible ways to measure returns, such as revenue generation, savings, efficiency, and accuracy gains, depending on their use case. In the near term, leaders are still rolling out this tech and figuring out the best metrics to use to quantify returns, but over the next 2 to 3 years ROI will be increasingly important. While leaders are figuring out the answer to this question, many are taking it on faith when their employees say they’re making better use of their time.